As an actor of transition, Amundi is committed to supporting the goal of net zero emissions by 2050.

As an actor of transition, Amundi is committed to supporting the goal of net zero emissions by 2050.

There is an urgent need to accelerate the transition of our economy towards a low carbon model in order to collectively reach the global objective of net zero emissions by 2050 or sooner.

As a pioneer in responsible investment, Amundi has a role to play in supporting investors wishing to participate in this transition.

As part of its efforts to address this challenge, in July 2021, Amundi joined the Net Zero Asset Managers initiative. This initiative gathers asset managers that are committed to working in partnership with asset owners on de-carbonization by:

Net Zero refers to a global state where the amount of greenhouse gas emissions produced and the amount removed are equal. It is an equivalent of “carbon neutrality”.

Reaching Net Zero relies on two pillars:

Read more

In 2015, under the Paris agreement, commitments were made to drastically reduce greenhouse gas emissions, bringing them “close to zero” by 2050. This agreement allowed public and private players to increase their climate engagement.

There is a global consensus that reaching the Net Zero objective by 2050 should avoid the worst consequences of climate change.

Read more

Global warming and the Net zero transition have far-reaching implications for investors notably as they will need:

For climate targets to be realized, asset allocation decisions can be implemented through different ways which are non-mutually exclusive:

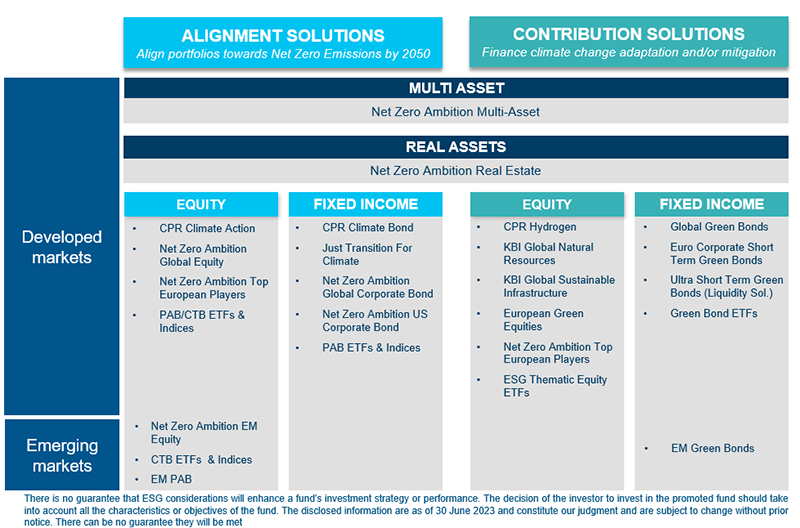

At Amundi, we are committed to providing a broad range of investment solutions that support our clients in their Net Zero journey.

Among these solutions, Amundi has built a Just Transition for climate strategy to address social impacts resulting from the transition to low carbon economies.

Visit the Amundi Institute to discover our must read articles, videos and podcasts dedicated to Net Zero.

Social impact innovative solutions reaching financial performance objectives.

A wide range of responsible solutions from open-ended funds to tailor-made Responsible Investment.

Acting as a responsible financial institution is a core commitment of Amundi’s development strategy.

This information is exclusively intended for “Professional” investors within the meaning of the MiFID Directive 2004/39/EC of 21 April 2004, and articles 314-4 and following of the General Regulations of the AMF. It is not intended for the general public or for non-professional individual investors within the meaning of all local regulations, or for “US Persons”, as defined in the Securities and Exchange Commission’s “Regulation S” under the 1933 U.S. Securities Act.

This non-contractual information does not under any circumstances constitute an offer to buy, a solicitation to sell, or advice to invest in financial instruments of Amundi or one of its affiliates (“Amundi”).

Investing involves risks. The performance of the strategies is not guaranteed. In addition, past performance is not in any way a guarantee or a reliable indicator of current or future performance. Investors may lose all or part of the capital originally invested.

Potential investors are encouraged to consult a professional adviser in order to determine whether such an investment is suitable for their profile and must not base their investment decisions solely on the information contained in this document.

There is no guarantee that ESG considerations will enhance a fund’s investment strategy or performance.

Amundi assumes no liability, either direct or indirect, resulting from the use of any of the information contained in this document, and shall not under any circumstances be held liable for any decisions taken on the basis of this information. This information may not be copied, reproduced, modified, translated or distributed, without the prior written approval of Amundi, for any third person or entity in any country or jurisdiction which would subject Amundi or any of its products to any registration requirements within these jurisdictions or where this might be considered unlawful.

This information is provided to you based on sources that Amundi considers to be reliable, and it may be modified without prior warning.