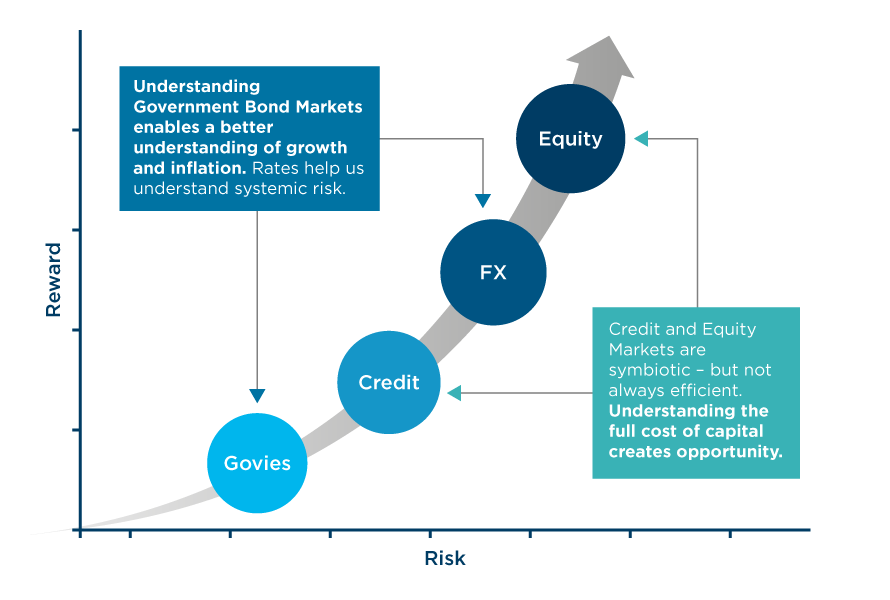

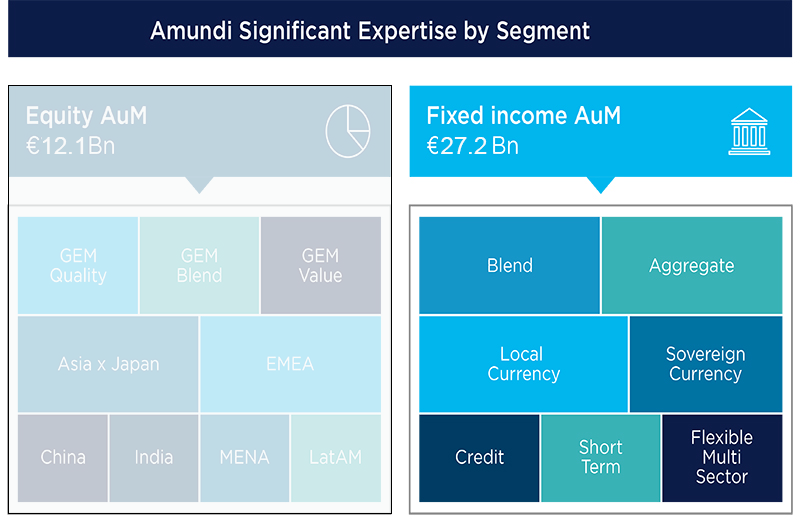

Amundi applies an integrated and research led approach to investing in EM, looking across equity and fixed income. We aim to create alpha and avoid permanent capital impairment in a highly imperfect market via a holistic approach. To do so, we have embedded risk management and portfolio construction capability with bespoke tools designed around the investment process.