In a nutshell

Credit markets have demonstrated a certain resilience despite the return of volatility in the equity market and record volumes of corporate debt issuance.

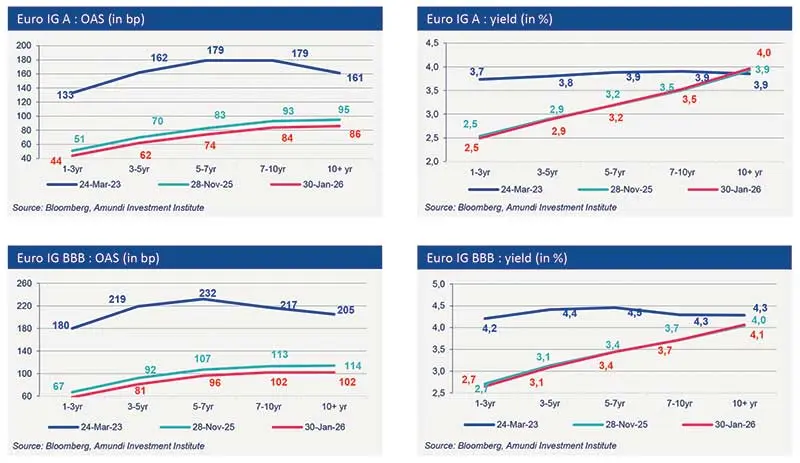

Spreads have been generally stable since the beginning of the year. Certainly, credit markets have experienced a widening of spreads since a low point reached at the end of January. In the United States, the Investment Grade (IG) segment saw its spreads increase by 6 basis points, while the High Yield (HY) market recorded a more marked widening of 31 basis points. The same trend has been observed in Europe, where spreads for IG and HY bonds also widened, by 4 basis points and 12 basis points respectively. However, the current level of spreads - except for the US HY market - remains close to or below the levels seen at the end of December.

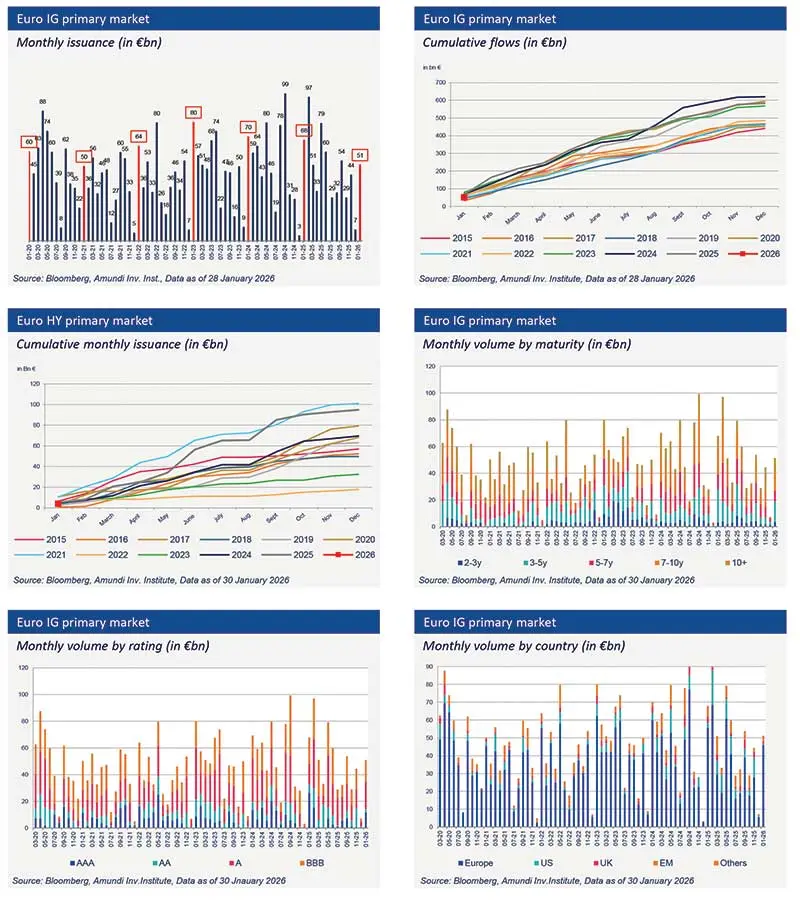

The volumes recorded in the primary market have been exceptionally strong and record-breaking in the US IG. Credit markets are experiencing a significant increase in issuance across multiple segments, driven by investments in artificial intelligence infrastructure. It is estimated that hyper scalers could bring to market over $400 billion in issuances in the Investment Grade segment this year. Due to this substantial volume of new issuances, bonds from tech issuers have underperformed compared to the rest of the credit market.

This significant increase in issuance has been fueled by robust demand from investors. The US IG has attracted record inflows. Investors want to take advantage of higher yield levels on debt compared to after the crisis, as a consequence of rising government bond yields. Strong demand is also explained by the solid fundamentals of companies. Unlike states, companies demonstrate prudent management of their balance sheets.

Financing conditions for companies are particularly good. The average borrowing premium that US and European IG companies pay compared to state debt has reached its lowest level since before the global financial crisis of 2008. The additional yield offered by High Yield bonds has also decreased significantly.

Primary market Investment Grade

Market data

Find out about our treasury offer