In a nutshell

Credit markets in October were dominated by renewed tensions between the United States and China, as well as by the nervousness triggered by the defaults in the private debt market of the automotive supplier First Brands Group and the U.S. auto lender Tricolor Holdings. Spreads are tightening again after reaching a high point in mid-October, except for the most fragile High Yield issuers.

Private debt is an asset class that has experienced significant growth in recent years and is now raising concerns about credit risk, liquidity shortages, and valuation levels. We do not view the current situation as alarming, nor do we believe that exposure to private credit poses systemic risks. However, this recent increase in risk implies giving greater importance to fundamentals in context of tight spreads.

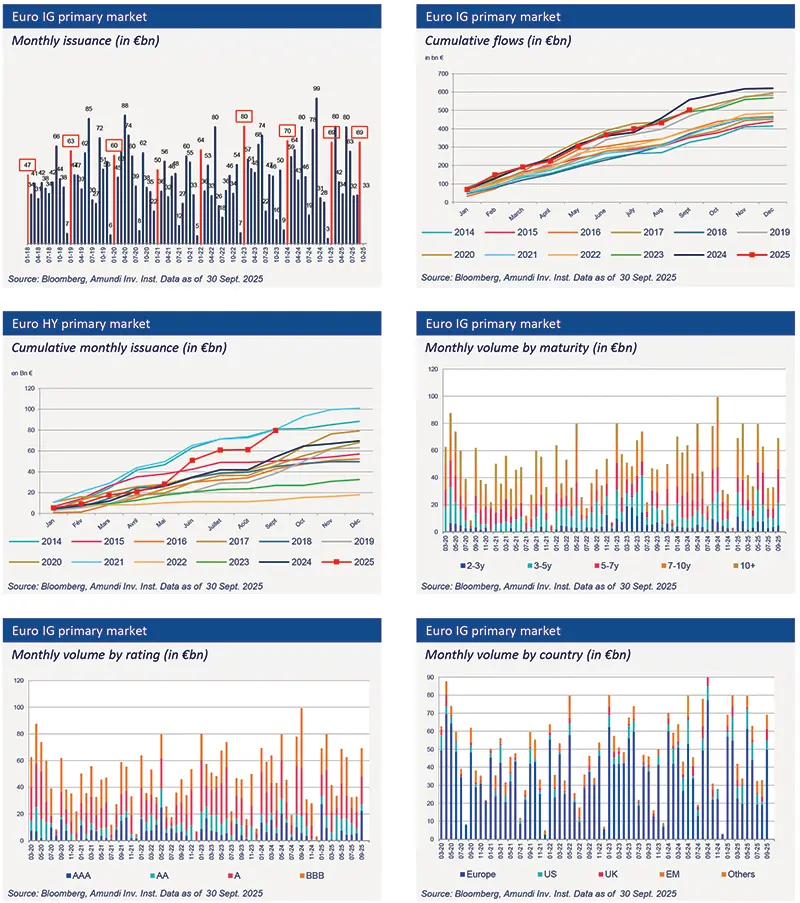

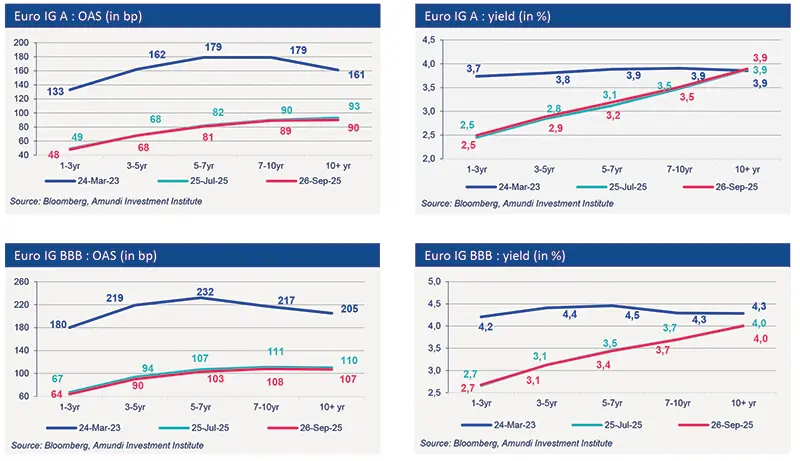

We remain constructive on credit as the context remains favourable for this asset class. First, the fundamentals of listed companies remain strong. U.S. and European firms have managed their balance sheets prudently, and strong demand in the primary market has allowed companies to easily refinance their debt maturities.

Furthermore, demand for fixed-income products should remain robust. Central bank easing in a resilient economic cycle creates a positive backdrop for risky assets. We anticipate rate cuts not only from the Federal Reserve but also from the European Central Bank. In this context, capital flows are expected to remain strong, with investors seeking yield alternatives in light of declining short-term rates. These rate cuts will therefore have a positive impact on credit with increased liquidity in this asset class.

Primary market Investment Grade

Market data

Find out about our treasury offer