In a nutshell

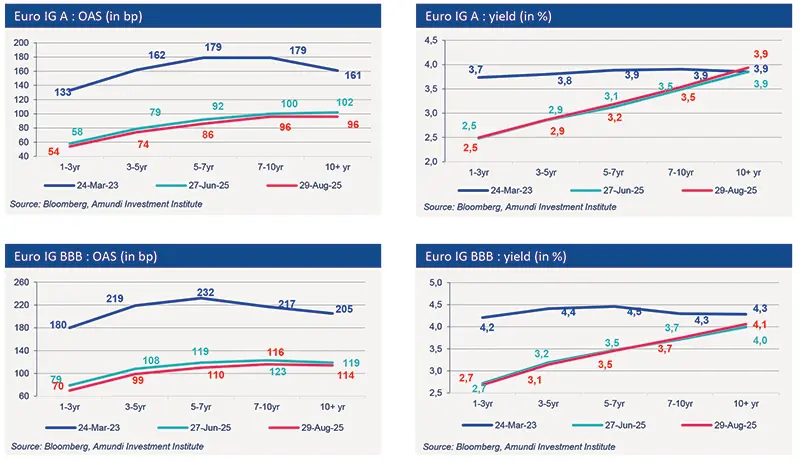

In September, credit spreads tightened again after the widening observed in August. The markets were affected by the volatility of sovereign rates and a notables low down Int he U.S. labor market. As of now, the spreads for Euro Investment Grade and High Yield bonds are approaching their lowest levels, reaching 76 basis points and 270 basis points respectively (as of 19/09/2025).

The economic context remains favorable for credit markets. Euro-denominated bond markets benefit from resilient growth, and a European Central Bank (ECB) that has some room to lower rates if necessary. In its latest monetary policy meeting, the ECB confirmed its decision to keep rates unchanged, a choice justified by solid economic activity, inflation approaching The 2% target, and a recovery in credit activity. However, the ECB remains vigilant to the numerous risks facing the eurozone economy, considering that inflation risks are present both to the upside and downside.

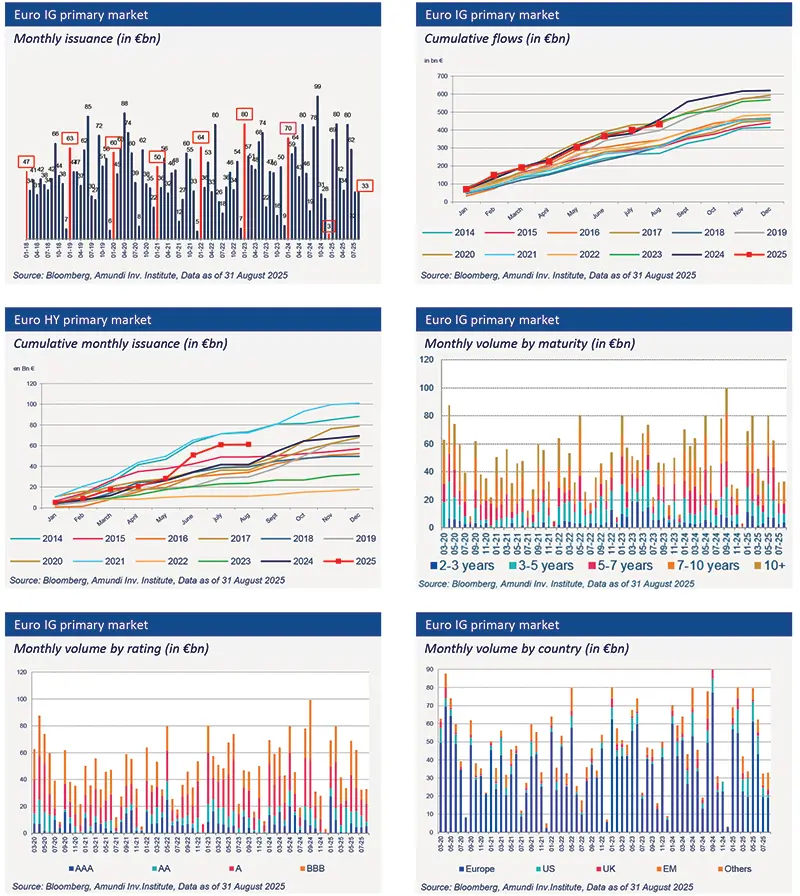

Demand for fixed-income products remains strong, with investors eager to capitalize on attractive yields. Currently, yields are competitive, with Euro IG at 3.0% and Euro HY at 5.0%. Additionally, activity in the primary market experienced a seasonal slowdown in July and August, followed by a solid rebound in September.

Finally, the fundamentals of businesses remain strong despite a slowdown in growth. It is important to note that the impact of increased tariffs is not yet fully visible. In recent years, companies have managed their balance sheets prudently, and sustained activity in the primary market has allowed them to effectively anticipate their refinancing needs, thereby reducing the risk of a "maturity wall".

Primary market Investment Grade

Market data

Find out about our treasury offer