Summary

Highlights

Monetary easing, fears about global investors’ moving away from the dollar and the Fed’s independence are underpinning gold demand, in our view.

Markets will look at upcoming US data for confirmation of the US economy’s slowdown and, hence, of Fed rate cut expectations.

Overall, the precious metal may offer good diversification1 benefits and stability from geopolitics tensions in the long term.

In this edition

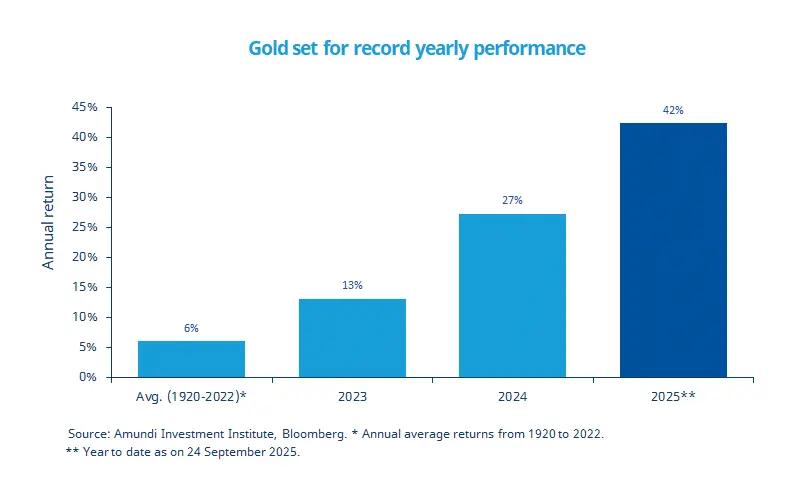

Gold prices set new record highs recently above $3,700 per ounce and are on track to deliver returns above 40% this year, the strongest yearly performance since 1980.

This stellar performance follows already strong gains in 2023 and 2024, and compares with the long-term average annual return of around 6.0%. While geopolitical risks were the main driver in the first half of this year, monetary easing expectations have been the primary driver in the second half so far, coupled with expectations of dollar weakness in a context of diversification1 of global portfolios. Looking ahead, rising fiscal deficits (excess of government expenditure over revenues) - both in the US and Europe - and high debt could support demand for the metal as a safe-haven asset.

However, high valuations mean we might see a pullback and volatility. In any case, we see the metal as a long-term call that could provide investors with stability from fiscal risks, geopolitical tensions, and a Fed inclined to cut policy rates.

Key dates

30 Sep China manufacturing and non-manufacturing PMIs |

1 Oct EZ inflation, US ISM manufacturing PMI, Japan Tankan index | 3 Oct US non-farm payrolls, unemployment rate, and ISM services PMI |

Read more

Read the full article on the Amundi Research center

1Diversification does not guarantee a profit or protect against a loss